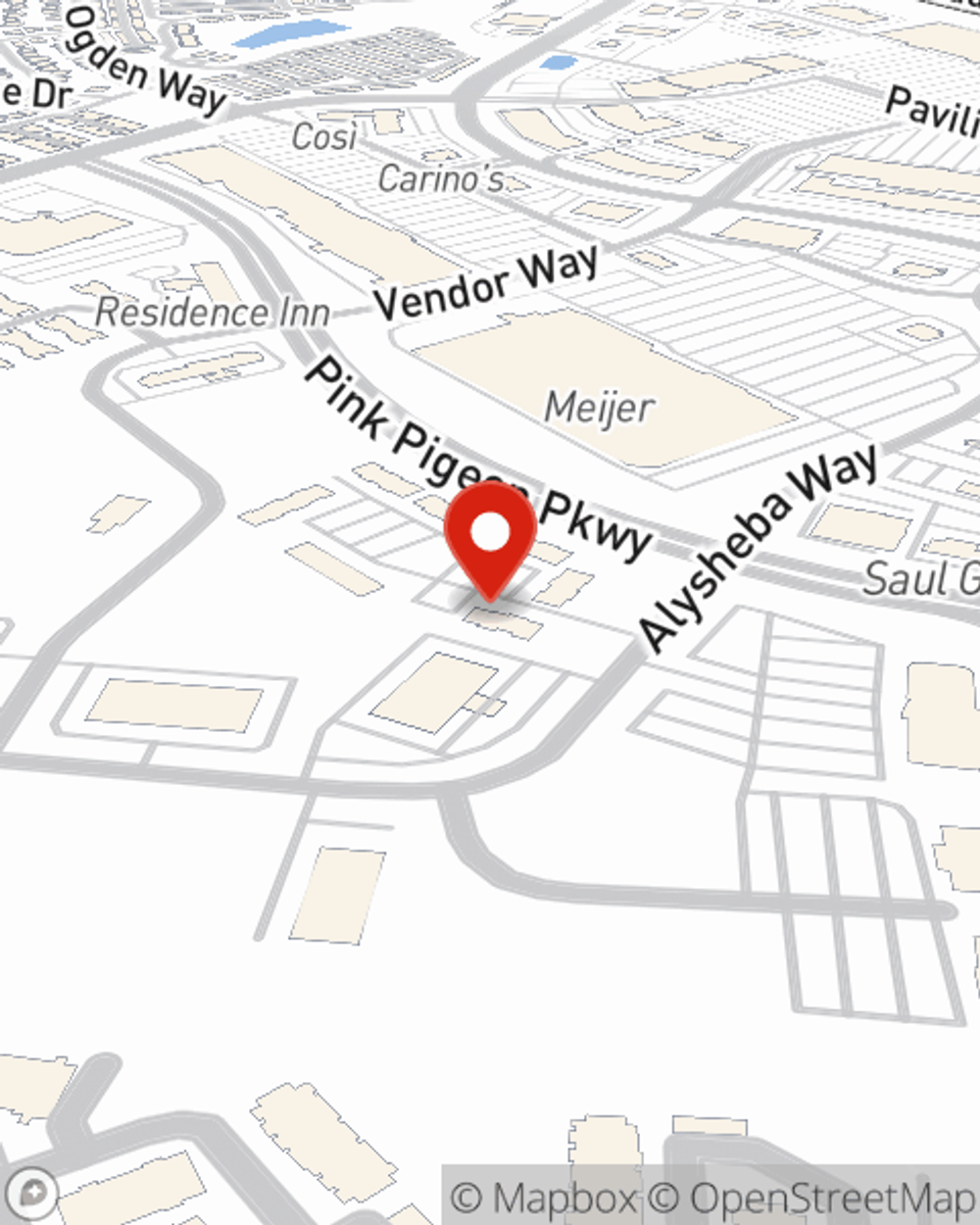

Business Insurance in and around Lexington

Looking for small business insurance coverage?

Helping insure small businesses since 1935

- Lexington

- Versailles

- Lexington-Fayette

- Nicholasville

- Paris

- Georgetown

- Winchester

- Lawrenceburg

- Frankfort

- Richmond

- Danville

- Berea

- Jessamine County

- Mount Washington

- Stamping Ground

- Lancaster

- Brannon Woods

- Centerville

- Midway

- Keene

- Vineyard

- Wilmore

- Pinckard

Coverage With State Farm Can Help Your Small Business.

Small business owners like you wear a lot of hats. From product developer to tech support, you do as much as possible each day to make your business a success. Are you a veterinarian, a surveyor or a dentist? Do you own a book store, a toy store or an appliance store? Whatever you do, State Farm may have small business insurance to cover it.

Looking for small business insurance coverage?

Helping insure small businesses since 1935

Strictly Business With State Farm

You are dedicated to your small business like State Farm is dedicated to fantastic insurance. That's why it only makes sense to check out their coverage offerings for commercial auto, builders risk insurance or surety and fidelity bonds.

Let's chat about business! Call John Parkhurst today to see why State Farm has been rated one of the top overall choices for insurance coverage by small businesses like yours.

Simple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.

John Parkhurst

State Farm® Insurance AgentSimple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.